A quick check of my article history on Seeking Alpha shows that I have never been a fan of Valeant, now known as Bausch Health Companies Inc. (BHC). But with the company having long since been pounded into the dirt, I am willing to look at a long position when I feel something has happened that presents a buying opportunity.

That opportunity occurred on Wednesday when the stock dropped by nearly half before recovering to be down -23% on the day over what I consider to be a suspect Chapter 11 bankruptcy rumor. I expect the stock to recover to approximately $7.50 - the price it was before this rumor gained traction - over the next few days.

Harvard Zhang appears to be a clout chaser

A clout chaser is someone who seeks attention, followers or users to their paid subscription services. You see this all the time in the fintwit space. Namely on Stocktwits where the feed of some random stock that was up 200% on the day is inundated with users who "called" the stock, with a screen capture of a mildly bullish statement made days or weeks prior with the massive gain in price attached to it. These posts are usually accompanied by a link to some kind of service or Discord chat. These users gloss over the other hundred or so posts they placed on stocks that didn't go on massive runs, hoping that not everyone will notice their cherry picking scheme.

A popular trend I see on X is wannabe sports reporters who claim to have an inside scoop on trades or free agent signings. They put out countless rumors then delete the ones that don't turn out but keep the few that were right purely by coincidence in order to make it look like they know what they are talking about or have special insider knowledge and connections. What happened to BHC might be the Wall Street version of that.

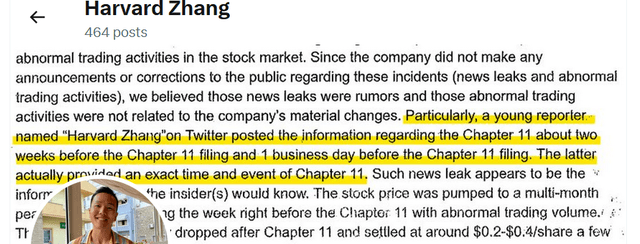

Harvard Zhang, Deputy Managing Editor - Distressed Debt at Reorg, has distinct elements of being a clout chaser. His X profile header is a screenshot of what appears to be some sort of article that mentioned him as a leading source of a bankruptcy filing:

I find this to be cheesy. It's the equivalent of me posting a screen shot of my Tipranks rating to my X account. Everybody has right and wrong calls in the market. Those who consistently get calls right and beat the market will gain followers and respect organically. They don't need to pump their own tires this hard. This was my first red flag when assessing the viability of this bankruptcy rumor.

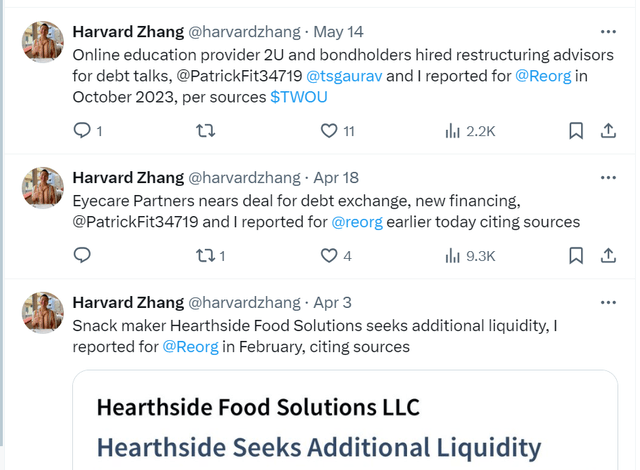

Zhang's 10 year old account has less than 500 posts. While I could not gather enough archived evidence to prove or disprove that he deletes tweets, of the ones that are there, I would consider them to be a hard sell for Reorg:

This screen capture is a good sampling of the tone and language around his tweets. Vague messages "citing sources", sometimes from months prior. It's not that difficult to take a look at a badly indebted company like 2U, Inc. (TWOU) and speculate that liquidity issues will arise at some point in time. He appears to be mixing in reasonable guesses of companies that will face liquidity issues with bankruptcy news that occurs a day or hours after reporting it. He is likely scouring court dockets and being the one of the first ones to report on any bankruptcy filings before companies file the bad news with the SEC. All in an attempt to make it look like he and/or Reorg has some insider knowledge and connections.

The other common factor in his tweets is that they always point to Reorg. Reorg is a subscription service for data, analysis and intel that claims to assist subscribers make better investment and business decisions. Ultimately this is what his efforts are all about. To promote Reorg's services and increase its visibility. Considering the very minimal interactions (likes, views and comments) on most of his tweets, the attempt doesn't seem to be gaining much traction.

Reorg's story changed as BHC denied any talks with creditors

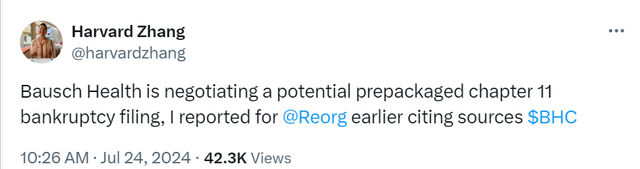

On Wednesday, Zhang posted the following on BHC:

The tone was notably more direct than usual, as Zhang made claims of a prepacked chapter 11 filing. Rather than the vague tone seen throughout most of the rest of his feed.

BHC categorically denied the rumors, stating that it is not in any talks with creditors for bankruptcy proceedings. In the release, BHC noted that Reorg changed its story to claim that BHC is not actually a part of the bankruptcy talks. Rather it's creditors talking amongst themselves. That's all well and good, but as long as debt covenants are being met by BHC and it doesn't default on any interest payment, that talk is nothing more than talk without the company at the table.

My speculation is that Zhang and Reorg were throwing out another reasonable guess on a distressed company, similar to the speculation on TWOU. Except this rumor had too much visibility and such a market impact that it prompted a response from the company that was targeted. Reorg then scrambled to change the story that it's all creditors talking among themselves to take the heat off the possibility that the firm put out fake news. However, Zhang's tweet is still there in its original form.

Disclosure: I have purchased some call options on BHC expecting the stock price to rise back to $7.50 shortly.

No comments :

Post a Comment