Note: This post was intially meant for Seeking Alpha, but didn't make the grade because Volatus is too small and illiquid. I guess the site wants the stock to run first and THEN let authors write it up. Since as we all know buying higher is how you maximize investor returns.

Drone Delivery Canada Corp. (TAKOF) (FLT:CA) has had one of the strongest cult followings I have seen in the Canadian microcap space. Before it earned a penny in revenue, it was trading at over a $200 million valuation in early 2018 shortly after it listed. At the peak of the COVID hype and easy money in early 2021, it neared a half billion in market cap despite quarterly revenue in the low 6 digits.

I attribute FLT's popularity in Canada to the high demand for speculative investing in drone businesses, but the lack of choices when it comes to that particular sector. This is where Volatus Aerospace Corp. (VLTTF) (VOL:CA) comes in. Volatus is another company in the drone space, but unlike FLT, it has shown it can aggressively grow its revenue in multiple verticals within the drone sector.

Within the current investing climate, the Canadian small cap space has been particularly hard hit. That has led to some overlooked and undervalued opportunities, with Volatus being one of my top picks. The stock is currently trading at $0.37 CAD. I believe that it's only a matter of time before it eventually hits $5.00. With that stock price increase coming from a mix of continued revenue growth, an ability to achieve cash flow positive operations within two years and improved market sentiment leading to more aggressive valuation multiples. VOL is a thinly traded stock, and it won't take much to send it into rocket ship emoji mode.

Comparing VOL to FLT: There is no comparison

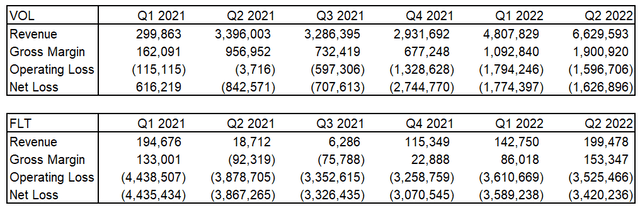

The chart below summarizes the financial performance of VOL and FLT over the last six quarters going back to the beginning of 2021:

In Q1 2021, the two companies had reasonably comparable revenue and gross margin figures. Since then, Volatus has achieved a very high rate of growth, a mixture between organic growth and growth through multiple acquisitions. In contrast, FLT has struggled to gain any momentum, with revenue in Q2 2022 being essentially the same as revenue in Q1 2021.

The bottom line numbers also show that Volatus is miles ahead of Drone Delivery. FLT has stayed consistently around the $3.5 million mark in net loss per quarter. Volatus saw its net loss grow while it was incurring substantial costs to aggressively expand, but now its gross margin has grown to the point where the net loss topped out in Q4 2021 and has come down over the last two quarters.

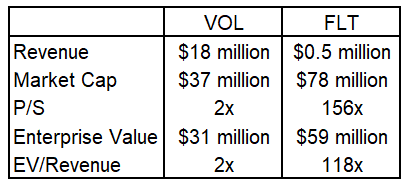

Despite VOL's far superior operating position, FLT has double the valuation:

The revenue multiple for Volatus is around 2x based on the trailing four quarters of revenue. The company has provided guidance of $38 million for 2022, so it's trading at around 1x of its 2022E revenue. Contrast that to FLT, which is trading at a 156 revenue multiple. Even when excluding its $19 million in net cash - a figure that will erode over $3 million per quarter based on current burn rate - the enterprise value to revenue figure is 118x.

While I think VOL can be a $5 stock eventually, if it was trading half as aggressively as FLT, it would be well over $5 stock right now. That's a testament to how these companies can't even compare when it comes to current operations. Anyone who bought into FLT because of the hype surrounding the drone industry and lack of investing options at the time should reconsider their position in the stock in favor of VOL.

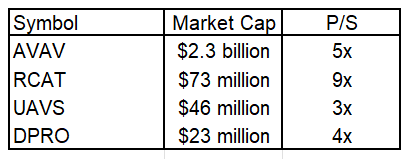

If one considers that FLT is just an overvalued outlier, there are several companies that are involved in the drone space that could provide more realistic comparison points. These are AeroVironment, Inc. (AVAV), Draganfly Inc. (DPRO), AgEagle Aerial Systems, Inc. (UAVS) and Red Cat Holdings, Inc. (RCAT):

Source: Yahoo Finance

Other than AVAV, these companies all have similar market caps to Volatus. Considering that about half of RCAT's valuation is covered off in cash, a reasonable industry revenue multiple is 4x. Keep in mind that this number is based off the current market climate where speculative investments have come down considerably over the last 18 months. In a more favorable environment, small cap drone valuations could see north of 10x revenue once again some time down the road. But for the decision point of investing in Volatus at its current market cap, it doesn't really matter whether we look at highly aggressive valuation multiples or more tepid ones. Volatus sits at the very low end of these valuations right now.

Of the three above listed small caps, UAVS is the one that comes closest to VOL's growth trajectory. Reviewing the company's income statement, Q2 2022 results showed $2.6 million in gross profit on $5.3 million in revenues. Superior gross margins when compared to Volatus. However, operating income showed a $5.4 million loss despite these better margins. Volatus is a lot closer to becoming cash flow positive than UAVS as it is a leaner company. I get into greater details into when I think the company will approach cash flow positive results in the next section.

Deeper dive on the numbers

As I previously stated, Volatus has provided guidance of $38 million for 2022. My recent communications with the CFO confirmed that this is still the number for 2022E revenues. The company achieved $11.4 million in revenue for the first half of the year, so that means the second half must reach $26.6 million, or $13.3 million per quarter. Quite a big jump if it's indeed true. Q3 will be out in a couple of weeks, and I expect to see revenue at least in the $10 million range for 2022 guidance to be achievable.

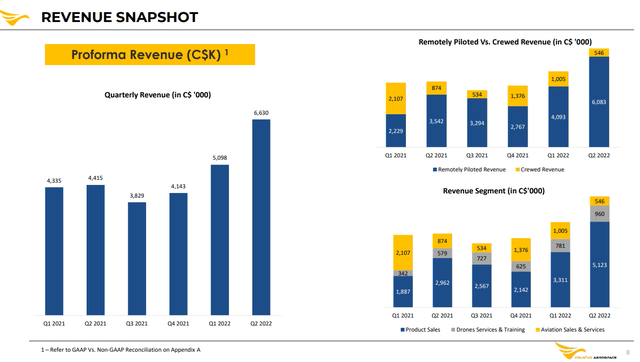

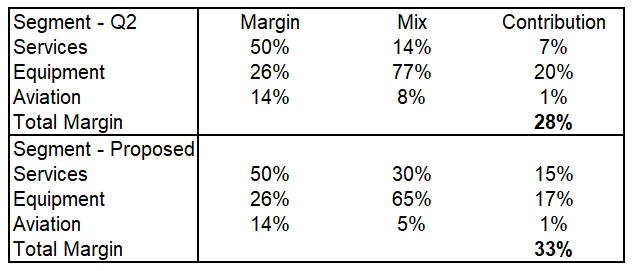

The Q2 investor presentation broke down revenues by segment:

The company derives its revenues from sales of drone equipment, drones-as-a-service, drone trainings, and traditional crewed aircraft sales and services. The vast majority of revenue to-date has been from equipment sales. The services side has been growing, but the company said growth was tempered thanks to seasonality as cold and snowy Canadian winters aren't conducive to high levels of drone activity. With the recent expansion to Latin America and Europe to offset seasonality and participation in the defense of Ukraine - along with the Canadian summer - the company has been hinting at very strong results for the drone services and training segment in the upcoming quarter. We will find out soon enough as results are scheduled to be released on November 7.

The aviation services and sales revenue is likely all generated from the legacy business of Partner Jet, the company Volatus merged with in order to go public. I don't view this as core revenue, but more of a complimentary piece that Volatus can offer its clients should they need it. I think this can be a competitive advantage for the company as there will be material regulatory and commercial hurdles to mass acceptance of beyond visual line-of-sight (BVLOS) services. Volatus has the ability to offer both manned and unmanned solutions for its clients during this transitory period. Volatus explained the decline in crewed services due to a pilot shortage and maintenance of its citation X aircraft. So the company isn't intentionally trying to wind down this business as these numbers would imply.

Gross margins for the three segments were 50% for drone services and training activities, 26% for product sales and 14% for aviation sales and services. The company has also provided guidance on gross margin for the year of 31%. So for it to hit that number, drone services are going to have to take up a substantially greater proportion of revenue going forward. For instance, gross margins can improve from 28% seen in Q2 to 33% going forward (and therefore hit the overall 2022 guidance of 31%) if service revenues increase from 14% to 30% of revenues while keeping the same margin by segment.

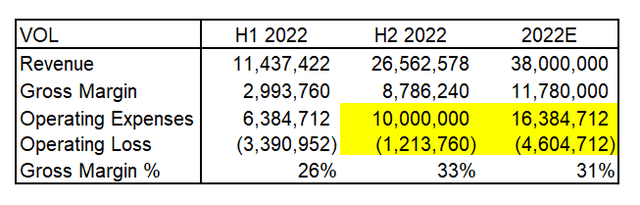

Assuming that the company does hit guidance, this is where things get interesting. This is a chart for the first and second half of 2022, based on the guidance provided for the full year. The numbers in yellow are my estimates or calculations based off of those estimates:

As I already mentioned, revenue would have to average over $13 million for the final two quarters of 2022. But gross margin would grow even faster, averaging about $4.4 million per quarter. Operating expenses were $3.5 million for Q2, and have grown about $700,000 per quarter since Q3 2021. With more acquisitions, hiring and marketing to fuel growth, I do expect opex to continue to grow. But how fast is anyone's guess right now. If opex averages $5 million for the next two quarters, the operating loss could be down to $600,000 per quarter. There is an outside chance that Volatus could reach breakeven results over the second half of the year.

Risks and issues for Volatus

Like any small cap which supposedly has a greater than 10x upside, there are going to be risks to holding such a high upside investment. The most obvious risk after reading the previous section would be the company's inability to reach guidance. The company would take a credibility hit if it were to end 2022 nowhere near $38 million in revenue. The offset to this risk would be that the market is already pricing in missed guidance or is otherwise unaware of its existence. So the downside to the stock price would be minimal.

Missed guidance would lead into the next risk, and that is as it stands now, Volatus has negative cash flow from operations. Assuming a burn rate of $1.5 million per quarter, the company would have enough cash to last for a year, inclusive of the most recent capital raise. There is a substantial risk that Volatus will have to raise again sometime next year before it can fund operating and acquisition initiatives from internal sources of cash flow.

The major sector-related risk is around BVLOS regulations and commercial adoption. As Canada is Volatus' largest revenue source (with the United States a close second), potential investors should familiarize themselves with current Transport Canada policies on drones. The good news being that the government agency is well aware of the necessity and benefit of BVLOS drone usage due to the country's vast geography. The United States also has a sparsely populated geography in the "flyover states". So I do expect policies in North America to be relatively progressive compared to other regions of the world. Volatus is also completely dependent on its drone manufacturers' ability to create the needed technology at scale.

As a rather obscure and lightly traded stock on the TSX Venture, VOL has significant liquidity risk. Someone who buys into the stock needs to do so with money that they won't need any time soon as there is no guarantee that they can exit quickly and at a good price. Other than one large volume day this month, VLTTF seldom trades. The flip side to this is that unlike FLT or other small cap companies that have seen their stock prices erode, VOL won't have the amount of share overhang from retail traders looking for tax losses or just to get out at break even. One strong piece of news or financial result could result in the stock price doubling and maintaining that level, regardless of overall market sentiment for the microcap space.

The eventual march to $5.00

I believe that it's only a matter of time before VOL reaches $5.00. How much time? That's the question. This company is still in the very early stages of its life, so trying to make multi-year projections and slapping on a price target within a certain time frame is pure guesswork. Rather, I thought it would be worth it to analyze what would it take for Volatus to eventually have a fair value of $5.00 and let the reader determine how long it will take or if it can reach that level.

Volatus has 114 million shares outstanding. There are over 30 million warrants and options outstanding with exercise prices ranging between $0.50 and $0.60 that would certainly get exercised upon the stock price exceeding $1.00. So the fully diluted share count is 145 million. Those warrants and options would bring in $18 million upon exercise, mitigating any need to finance in the future. However, given this company's history of aggressive acquisition, I think there is a strong possibility of more share issuances to fund further deals, regardless of the company's ability to generate cash flows from operations. As a $5.00 target is a long-term endeavor, I am going to assume a 170 million share count by the time this target becomes a legitimate possibility. A $5.00 stock price implies an $850 million market cap.

The current multiple for the drone sector is 4x; however, that's after a massive shedding of investor funds from speculative technology plays. By the time Volatus threatens $5.00, the economy and investor sentiment should be in better shape. I will assume a 5x revenue multiple.

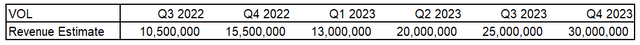

Therefore the math works out to $1 in revenue per share outstanding. $170 million in annual revenue in total. If guidance is indeed met for 2022, that would require $26 million in revenue for the final two quarters. Likely in the form of $10-11 million for Q3 and $15-16 million in Q4. Q4 would then become the jump off point for fiscal 2023. Assuming a seasonably weak Q1, 2023 numbers could plausibly look something like this:

This would lead to about $88 million in revenue for next year. That seems incredible for a company that just recorded $6.6 million in revenue for its last reported quarter. But in the context of its guidance, actually looks quite achievable. From there, the company would have a $30 million jump off point for fiscal 2024. Four quarters of modest growth would result in annual revenues of around $150 million, with $170 million being met or exceeded in 2025. Given the early stages of growth, readers can take this with a grain of salt but at least I illustrated the potential.

This estimate is predicated on Volatus meeting its guidance for 2022. If it's not met, $170 million in annual revenue could be stretched out to a significantly longer time frame, if at all. However, one doesn't need to see a $5.00 stock price in three years to make a case to buy the stock at $0.37 today. I am holding my position in Volatus in anticipation of the Q3 results that will be coming next week. A strong result could see a material move up in the stock price and bring clarity over the plausibility of the 2022 guidance being met.

Disclaimer:

This site is operated by Edward Vranic. I own a long position in Volatus.

Any

articles, tweets, stocktalks or any other form of dissemination in

person or online are all the sole product of my personal opinion. I may

hold positions in securities I mention and reserve the right to open,

close, or modify positions at any time

without notice. The information provided herein is strictly for

informational purposes

only and should not be construed as a recommendation to buy or sell, or

as a solicitation of an offer to buy or sell any securities. I am not a

registered investment adviser nor I do not hold any licenses.

Individuals are encouraged to consult with their personal financial

adviser for financial advice.

There is no

guarantee that any estimate, forecast or forward looking statement

presented herein will materialize and actual results may vary. Investors

are encouraged to do their own research and due diligence before making

any investment decision with respect to any securities discussed

herein, including, but not limited to, the suitability of any

transaction to their risk tolerance and investment objectives.

You

agree that by reading my material, you are acting at your own risk. In

no event will I be liable for any direct or indirect trading losses

caused by any information contained herein or in other dissemination

methods. I make no representations, and specifically disclaim all

warranties,

express, implied, or statutory, regarding the accuracy, timeliness, or

completeness of any material contained in this site. I do not guarantee

that I am providing all of the information that may

be available on any topic written. I recommend that you do your own due

diligence and consult a registered financial adviser before buying or

selling any security.

Trading in securities involves

risk and volatility. Past results are not necessarily indicative of

future performance. My conclusions are the result of my personal due

diligence and have been wrong in the past and will be wrong again in the

future.