https://thedeepdive.ca/ is a site that built a reputation and a following years ago as one of the few out there willing to do detailed financial and other critical analysis of Canadian penny stocks. This is a valuable endeavour as a lot of coverage on Canadian small caps are promotional or long-biased in nature and often distort or ignore bad news or caveats that may be buried in SEDAR filings.

Unfortunately, over the years The Deep Dive has degenerated to the point where most of the blog posts on there are complete wastes of time to read, all wonderfully dis-organized into a massively cluttered mess of a website. I suppose, just like news outlets such as CNN, the site struggled to find a way to monetize its content and concluded that low quality SEO clickbait articles was the best route to go. There's nothing wrong with trying to earn a living, but poisoning the "Deep Dive" brand is a bit of a bait and switch if most of the articles on there are fluff. May I suggest that the site changes itself to "The Shallow Pump" instead? theshallowpump.ca is still available on GoDaddy.

(As an aside, when you become an ACTUAL SUCCESSFUL investor, you don't need the few dollars generated from web traffic to support you, *wink wink* - successful analysis and successful investing should eventually go hand in hand.)

As a result of The Deep Dive's steep decline in quality, I just stopped following the Twitter account and stopped reading their content. Their Twitter account still follows me - we shall see how long that lasts - and they have far more followers than I do, along with some followers who I follow and respect. So The Deep Dive brand still has credibility in the Canadian microcap space.

Now I was willing to let sleeping dogs lie and just forget about this site as a mostly irrelevant shell of its former self. But then The Deep Dive had to try to tap into half of its old school roots (the critical part, not the analysis part) and feign righteous indignation over the poorly researched and sloppily written short report on PKK from Grisly (sic) Research:

Had The Deep Dive done a little bit more analysis and been a little bit less critical, or at least waited for a proper response from PKK itself, it might not have posted this. Nor this on its website to amplify the Grisly false narrative. PKK provided its full response the next morning and the market reacted positively, erasing that 18% decline and then some. The Deep Dive is not that clueless. They are experienced market players for years. They know very well that in the legally sensitive and deeply personal situation PKK was put in, it needed some time to explain itself and have that explanation go through the lawyers. A few hours was not enough time for such a quality response and yet The Deep Dive piled on the fear campaign anyways.

I find this is the perfect opportunity to speak out against what The Deep Dive has turned into. I'm only an individual investor with a couple thousand followers, but I figure that with all the pent up anger felt by PKK shareholders, now is the best time to voice my opinion as it will be spread to maximum effect. The Deep Dive or one of their supporters could brush this off as "oh, he's just upset because they said something mean about his precious PKK stock". That may be true. But all I ask is to analyze and debate the CONTENT of my argument. Not the motivation for making the content in the first place. Isn't that a fair request?

The irony with short sellers and other critical players is that they feel they can act with impunity by calling out penny stocks and other potentially shady businesses. This is actually a good and useful service. However, just like they should be allowed to be critical of penny stocks, other people should be allowed to be critical of THEM. The Deep Dive has gotten away with being a hollow shell of its former self for years without anyone to my knowledge calling them out for it. It might finally be their time to have a short report hit piece focused on them.

The issues I have with The Deep Dive can be summed up in one screen capture on a recent paid promo fluff piece on Rockland Resources:

The two statements below RKL's stock price at the end of the article are hilariously mutually exclusive for The Deep Dive. You CAN be paid AND provide analysis on all aspect of the firm - including business opportunities, assets, skill level of management, financial analysis, and any "deep dive" potential red flags buried in SEDAR or SEC filings - but this is clearly NOT what The Deep Dive is doing.

Before going further, I need to preface that I have nothing against RKL. I have no opinion whether to buy or sell the stock, and wish the company well. As an exploration or start up mining company, I understand its position. It has a typical exploration business model where it achieves marginal or no revenue and spends money hoping to explore a property and build out a resource, among other corporate expenses. I also know that it has to spend money marketing its stock. Why? Because until a cash generating outcome is achieved (buyout, sale of property, royalty deal, or eventually cash flow from operations) its only source of funding is through the selling of securities, usually through the issuance of common shares. In this situation, a company needs to promote its stock so it can have a robust stock price and dilute less shares at a higher price rather than more shares at a lower price. I am merely using the RKL article to expose The Deep Dive's inconsistent and dishonest practices. Sorry RKL, you're going to be dragged through the mud a bit as collateral damage.

This was The Deep Dive's response to when I called them out for feigning outrage on PKK while simultaneously providing one-sided paid coverage on their site:

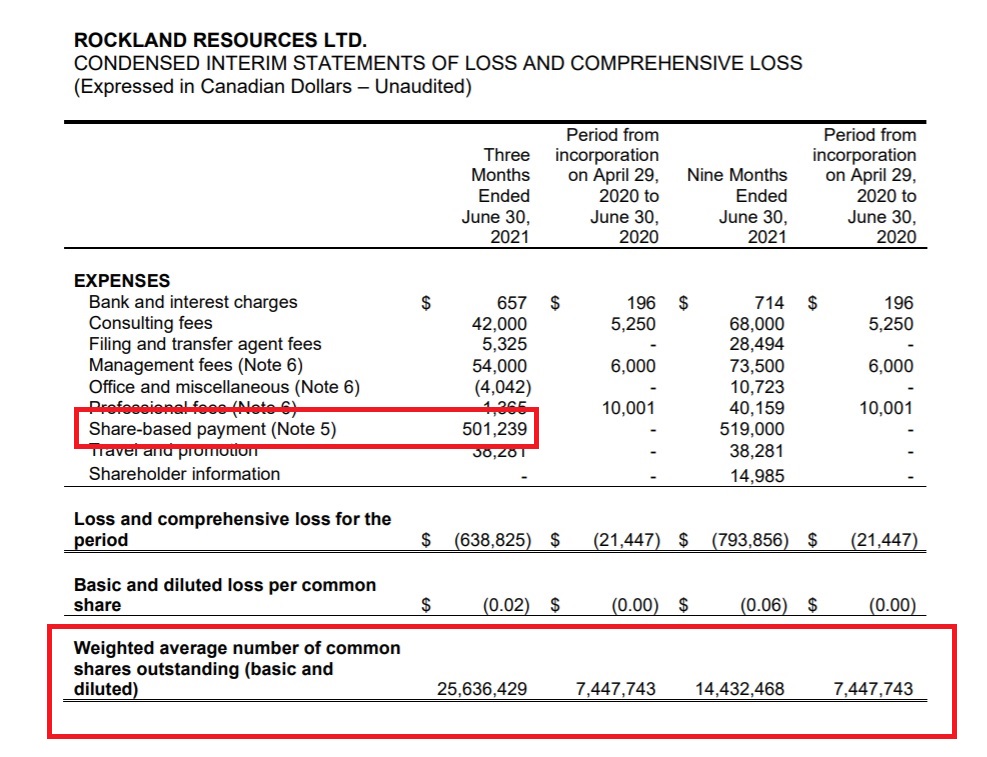

Keep in mind that they vet all of their clients. So they are very well aware of financial state of any company they end up promoting, assuming their "vetting" process is anything more than if the company paid them on time. Let's review RKL's latest income statement ended June 2021 from SEDAR:

As expected, there is no revenue. There are also expenses that are to be expected for a start up exploration company. One thing that stands out is the $500,000 in share based payments over one quarter. For context, at $0.17, RKL has a market cap a little over $4 million. That is a substantial expense for a company this size yet The Deep Dive didn't think that was appropriate content for their audience to know as part of their focus on "all aspects of the firm". In my opinion, that $500,000 worth of share issuance is reasonable as it's mostly related to normal business expenses for a startup like capital raising costs and the purchase of properties. This isn't about RKL so I'm not going to get into details - read Note 5 of the company's financials if you're that interested - but The Deep Dive should have gotten into the details on their article as part of having full editorial control. The tripling in shares outstanding over one quarter was also completely ignored. As the company now has nearly $2 million in cash from the capital raise, one can reasonably expect the dilution to occur at a much slower rate going forward. But that's also something that should be mentioned when writing about "all aspects of the firm".

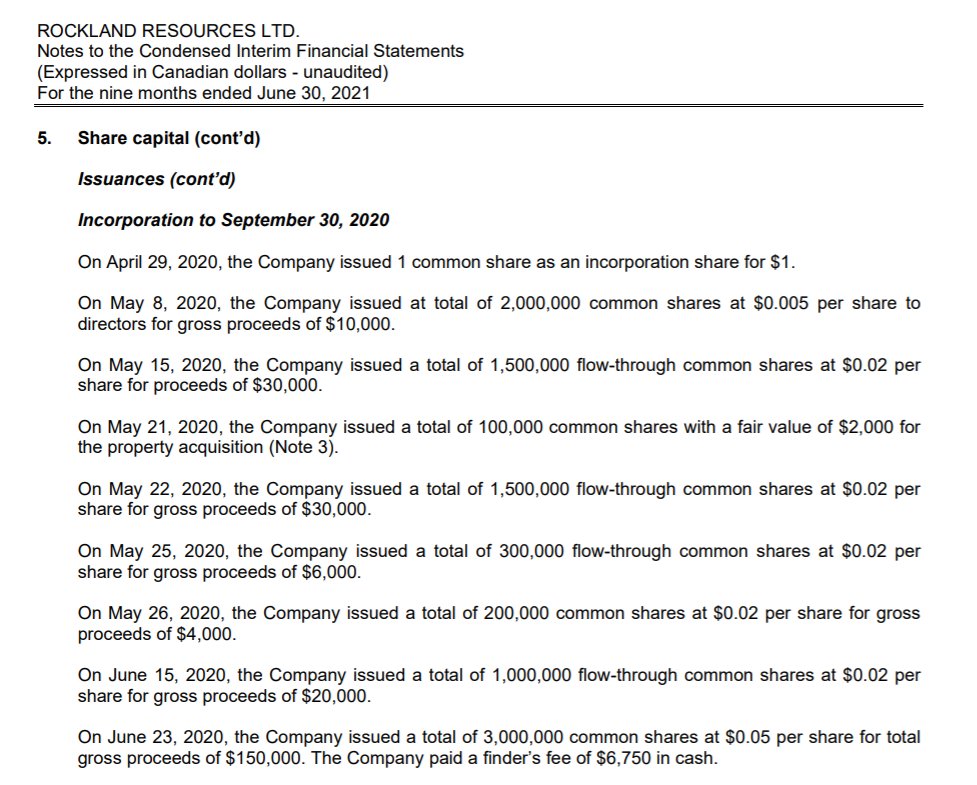

There is something in Note 5 of RKL's financials that I particularly want to highlight:

Last year, the company issued a bunch of shares at well below today's stock price, and well below its 52-week range of $0.11 to $0.285. This includes 2 million shares issued at half a penny for $10,000 to directors. 2 million shares is 7.7% of the total shares outstanding. More shares were issued at $0.02 or $0.05. Remember that The Deep Dive vets all of their clients. At $0.17, the site is actively promoting a stock at a price that is 34 times what insiders paid and several times more than the price of these other share issuances. This is a textbook liquidity opportunity for early stage investors at high returns for a company that hasn't done much yet except become publicly listed. Nothing necessarily wrong with that, but it should be something which potential investors are made aware. The Old Deep Dive would have been absolutely all over this in any report they did. Then let investors figure out themselves if they want to pay 34 times what insiders did. The New Deep Dive? Meh, whatever pays the bills I guess. Keep that part out and excuse it with:

This is dishonesty by omission, and the editor is excusing it with "well we have several forms of content". I used to respect The Deep Dive as one of the few honest penny stock writers out there. I didn't always agree with their conclusions, and they once called out a company I was long on (turned out they were right), but I at least respected their analysis. It was reading up and absorbing some of what they do, among others, as well as some critical comments on my Seeking Alpha articles that helped me to refine and improve my own analysis and articles. Both from a long and short perspective.

However, in the end The Deep Dive just turned out to be another paid shill with absolutely no integrity. Even worse, they occasionally pretend to still be in their old critical analysis days by feigning outrage or concern over PKK's immediate behaviour after a short report. Without any effort into analyzing if the report had actual merit. Do you honestly think that if RKL was under attack like PKK was that The Deep Dive would react in the same way? I don't. Maybe this is part of their strategy to keep retail investors around and invested in their own paid promotions. Getting retail investors to think "Well, they didn't like that PKK company, but they like this RKL company, so that one must be REALLY good if they are so picky. I'll buy that."

Fuck thedeepdive.ca.

I want to end this piece with some clarification before someone points out the potential hypocrisy of my righteous indignation over The Deep Dive's righteous indignation on PKK. I am a writer and I have gotten paid in the past. Very seldom, less than 5% of my articles in my lifetime were compensated. I also have an all-encompassing disclosure below. As I have been very successful investing recently, I am actively refusing any paid work that might come my way. However, I wanted to provide an example of one the more recent compensated articles I wrote:

This was on Datable, DAC, and I was bullish on it at the time (no position today). Like many penny stock long picks, it turned out to be wrong and the stock is down around 50% from the time of my article three years ago. While my bullish thesis didn't work out, I still provided details of the financial, technical and business risks that I felt existed. My opinion is my own and I could have missed something, but no one will read that and say it was one-sided overly bullish analysis.

Just like I took apart one article from The Deep Dive, I'm sure someone can look through the catalogue of my several hundred articles out there and find something that is "less good" than the others and try to take it apart. There are a couple of differences though. First, my articles, particularly the compensated ones always have at least some kind of fair financial or risk analysis, even if there is a bullish slant on it overall. The Deep Dive's piece on RKL was pure fluff that completely ignored all possible risks to owning the stock. This was not an innocent oversight, but a direct and intentional omission. Second, I'm not the one marketing myself as "The Deep Dive". I'm just an individual investor who writes on his blog and on Seeking Alpha. I don't make any particular claims or try to brand my work as something bigger than it is.

One last point. I have never gotten paid one red cent from PKK over several years of writing about the company. However, my writing and constant contact with management allowed me an opportunity to buy into Cubeler as a private company at a $3 million valuation for $20,000. That led to an exit with 48,000 PKK shares plus some cash that is now worth nearly $500,000. This is advice for anyone trying to make it in this industry. You can make A LOT more being a successful activist investor than being a paid shill writing for a few bucks.

One also has to wonder about these paid shills out there. If they have been at this for years, and are still begging companies for contracts, how bad of investors must they be? Why listen to their advice if they suck at investing to the point they still have to do compensated articles in order to put food on their plate so many years later? At some point you would think they would graduate to successful investor making a living off of that alone with no need for side hustles. They might still write for fun as I do, but would have no need to monetize their content. Just some food for thought.