One stock that I have been particularly fond of in the past and continue to patiently hold through this multi-year bear market in the small cap space is Sparta Capital Ltd. (SCAXF) (SAY.V). After numerous conversations with John O'Bireck - the former Chief Technology Officer and President of Sparta - and seeing improved financial performance, I think the company is finally ready to take the next step, even though it has to be without him. But before I get into the analysis of the company, I'll go on a bit of a political rant.

I exist in the ever shrinking Venn Diagram of people who are right-wing politically but who are also genuinely concerned about climate change and the environment. I'm just a realist over what that entails. If we listen to left-wing, globalist politicians like Justin Trudeau who attend the Paris Accord in his private jet in order to fellate himself and other politicians like him over bullshit 2050 targets, we won't ever stop climate change. The only way we can possibly beat climate change through this top-down method of government intervention is from a substantial decrease in the human population and substantial decrease in the quality of life for those who remain. And if we do nothing, there will be a substantial decrease in the human population and substantial decrease in the quality of life for those who remain anyways as the impact of the changing climate gets more pronounced.

The uninformed masses talk about electric vehicles like they are going to be the big saviour. When in reality all you are doing is pushing much of the carbon usage upstream where the end user doesn't see it coming out of the back of their vehicle's tailpipe. Everything to do with the sourcing of materials, production, charging and eventual disposal of the car battery in an EV is a dirty business. That's why I invest in and/or support companies like Abaxx and any of Robert Friedland's initiatives (SRI.V briefly spiked a few weeks ago thanks to positive news on VRB Energy's vanadium storage system), because they have a strong understanding of the problems that need solving within that sect of the energy transition. Any source of travel other than walking or riding a non-electric bike is a source of emissions with the current state of energy creation right now.

But travelling is just one source of emissions. The global farming and food production industry is another major source, about 30%. You know, that thing that supports some of the 8 billion or so people on the planet from starving. When people talk conspiracies about population control or eating crickets, there's no conspiracy. That's just math. If society wants to cut emissions in half by 2030 and become carbon neutral by 2050, the industry responsible for 30% of those emissions is going to have to take its fair share of the hit.

Faced with difficult choices for what battling climate change will actually entail, those who support movements that they think are other people's problems like the neutering of Alberta's oil industry will soon fall on the same side of the "evil climate deniers" when it's their turn to make sacrifices. I call them environmental NIMBYs. Much like we see with every other "kind and progressive" initiative. People want waiters, cashiers and other low paid workers to be paid more, but don't want to pay more for their goods. They want addicts to have safe injection sites, but don't want those sites close to where they live. They want affordable housing, but not in their neighbourhood if it involves taking down trees or blocking their skyline. They want society to battle climate change, but not if it involves any sacrifice or declining living standard for themselves (but bankrupting the Canadian oil industry in favour of Saudi oil shipped from overseas is okay).

So we can either go ahead with the left-wing, government-controlled version of battling climate change, which will eventually fail because no one or only a small percentage of people will want to ride their bikes everywhere, eat crickets, densify their neighbourhoods and stop having kids. Or we can do what humanity has done in almost every instance up to this point and rely on technology and free enterprise to get us there. I choose the latter more realistic option. That includes nuclear (any climate change mitigating opinion that doesn't include nuclear energy needs to be thrown into the garbage can). That includes "politically correct" renewables (as long as there is honesty about their downsides and limitations). That includes carbon capture technology and potentially even grand capital projects like solar shields over the arctic. That includes scientists working with business leaders - yes, even in oil - to come up with any solutions necessary to mitigate the impacts of a warming planet. Governments will have a role to play, but that should be limited to the doling out of cash to eco-capitalists and entrepreneurs. Preferably the startup type created by Canada's smartest and most business-savvy citizens. Instead of flashing hundreds of millions of dollars to multi-billion dollar international corporations like Stellantis, governments should be funding local projects created by Canada's best and brightest. Sparta Capital can be one of those companies.

Sparta is just one small Canadian company looking to battle climate change. It's not going to be an answer to everything. But if we want to win this battle, we need to do it by supporting thousands of Spartas across the country.

Unfortunately, I had to re-write the next several paragraphs due to the untimely death of John O'Bireck. While this was meant to be an assessment of his strengths and weaknesses as the "face" of the company as prime decision maker and point of contact, it'll end up being a tribute to someone who I got to know as a person and friend. I initially wrote this piece back in mid-September and shared it with Sparta for feedback. That's when I first met John's daughter, Taylor O'Bireck, who asked me to delay posting it until Sparta was ready. I learned after the fact that John had kept his illness quiet from shareholders and other people close to the company as he was convinced he was going to beat it and there would be no issue. That similar level of optimism is what is needed to tackle the environmental and health care challenges faced by Canada and the world. As opposed to having "climate anxiety" seen among so many people today that helps absolutely nothing.

Like me, John was also in that aforementioned Venn Diagram. A surprising amount of people I have encountered in the small cap Bay Street world didn't like him that much. I get it, though I think these people far underestimated him. He had some weaknesses in terms of being organized, taking care of financial reporting and other tasks required in order to run a public company. For instance, I waited on a new investor presentation and website promised months ago that I didn't receive until his daughter started working for the company. However, he was the smartest guy I know in terms of environmental issues, energy transition and knowledge about how the electrical grid system works. He was kind of like the Jordan Peterson of the environment. Long-winded, but also has some strong opinions and big ideas about his area of expertise. However, unlike Peterson who spends all of his time trying to gain sympathy on social media, John was out there doing something. The irony being is if he spent more time trying to gain social media points, SAY's stock price would probably be a lot higher. I figure in hindsight that his illness and the fact that he took on too much likely contributed to his perceived weaknesses.

Despite his last name sounding Irish, he's of Polish descent. He was a mix of that pro-freedom of choice, anti-communist, pro free enterprise eastern European sentiment you see prevalent in Etobicoke (west side suburb in Toronto) with the underdog and pro-immigrant attitude of Scarborough (east side suburb of Toronto). Investors

I introduced to him who aren't so closely tied to Bay Street tended to

like him or at least found him interesting and capable in his field. Anyone who voted for Rob Ford back in 2010 for mayor (there's a picture of Rob Ford touring Sparta's plant as soon as you come in the door of the Scarborough office) would have liked this man. People who support grassroots parties like New Blue in Ontario also would have liked him. If he had been a politician, Canada's various right-wing parties would have transformed from the perception of climate deniers with the worst environmental policies to the best. The narrative of battling climate change centers around energy

transition, reduction and taxation of emissions and the demonizing of

any oil/coal industry where doing so won't result in you getting

executed (ex. Alberta and the Appalachian region). But one thing that is

hugely overlooked is the reduction of waste. As an electrical engineer, John's passion was the grid system and the way energy transmits. He was aware of the huge inefficiencies that exist within that grid system

and Sparta is working on solutions to that.

John was a unique individual who knew his craft. Sparta can always hire someone to do some of the financial and corporate work. And that's where Taylor comes in. After getting to know her briefly over the last few weeks, I realize that she has a similar passion for and knowledge of Sparta, but is polar opposites of John in other ways. Sparta has been grooming her to take over for John for a while, but his death now accelerates this process. Her recent addition to Sparta reeks of nepotism, but if people get to know her, they will realize that she is exactly what Sparta needs. John was a product builder, relationship builder and problem solver. But Sparta already has enough products, its Technical Advisory Board could fill out a baseball team and the problem it needs to solve right now is getting to consistent profitability. It doesn't need more products or relationships. What it needs is a business builder, and that's what I beleive Taylor can bring to the table.

Sparta is a conglomerate of several wholly and partially owned subsidiaries in the environment, energy and health care space. First and foremost is ERS International, an electronics recycling/upcycling plant located right beside the old Lawrence TTC RT station in Scarborough. This is the company's most advanced operation and the bulk of its reported revenue right now. I like to say that Sparta's clients are everyone and no one. In that every big company around the GTA will use Sparta, and no one will admit to doing so. Sparta is considered to be a janitor by some, but in reality the company is more of a "fixer". ERS handles and destroys sensitive data and other things that its clients would prefer to not get into the public. Every single costly mistake or purchase that would lead to shareholders thinking their company is being led by a bunch of incompetent clowns is discreetly upcycled, repurposed or disposed of by Sparta. The company is also forward looking into the realities of what the green energy transition will actually look like. For instance, there is going to be a bumper crop of worn out solar panels ready for the landfill in a few years, and the research being done at the ERS plant will try to ensure that doesn't happen. That's in addition to the more in vogue R&D taking place there, such as Sparta teaming with the University of Ottawa to try to upcycle lithium batteries.

The Energy division is not quite as straightforward to explain and intuitive to understand as the activities at ERS, but once you see the product first hand, you'll realize that this has the best potential out of anything Sparta has to be the most scalable revenue growth and have the biggest impact on climate change. This is a brief explanation of the subsidiary, taken from Sparta's latest MD&A:

"Sparta Energy is the collective term for a group focused on upcycling "lost" or "wasted" energy. The flagship Illumineris entity provides a complimentary suite of technologies to analyze and assist its commercial and industrial clients in receiving value from wasted sources of energy within their existing power systems; with zero cost outlay. This includes; peak power mitigation systems through energy storage technology - eliminating black-out and brown-out conditions while significantly reducing global adjustment charges; power-factor and harmonic mitigation that brings plant voltages and currents back in sync while cleaning the electronic power systems - reducing costs through efficiencies and maintenance; LED lighting retrofits - cutting consumption by 60% - 80%; photoluminescent safety products that provide required safety lighting systems with zero energy costs; and IoT (Internet of Things) monitoring systems that can measure, monitor and optimize various energy systems in commercial and manufacturing facilities; all intended to help reduce power losses and corresponding costs."

There is no reason that this kind of energy saving system shouldn't be in the facility of every single manufacturer in Southern Ontario.

When I say that I don't trust the government to be effective in leading the way against battling climate change, I look to the failing state of Canada's health care system as proof of that. It's a bloated and disparate group of bureaucracies at the provincial and hospital level that lead to overspending, doctor and nurse shortages and wildly inconsistent levels of care between different regions of Canada. When the politics nerds say that federalism isn't working in Canada, it's the health care system that is the first exhibit when justifying that opinion. Sparta's third division is the one referred to as "Innovation" which contains TruckSuite and various other health care initiatives. The trucker anti-lockdown/vaccine mandate protests were controversial in Canada. Without getting too involved into the politics of that movement, the way the world is organized is not really built for truckers and COVID just exasperated the issue. When truckers are on the road, they can't easily access doctors or medical facilities. When truckers stop, they go off on truck stops which are often in the middle of nowhere. You can find dining options at these places, but not doctors. White collar workers who work in the city might be able to take a couple hours off of work to go to a doctor's appointment, but that's not an option for truckers. As a result, truckers tend to be one of the demographics that habitually avoids going to the doctor. TruckSuite is leveraging technology and AI to develop and implement health care monitoring solutions for truckers to improve efficiency and safety. In layman's terms, if a trucker is at risk of a stroke or a heart attack, TruckSuite is going to alert them to this possibility and facilitate medical follow-up so that the trucker doesn't suffer a medical event while on the road.

Canada's shortage of medical professionals and aging population is putting a further strain on the already compromised health care system. Part of the immigration Ponzi scheme is to prop up a tax and employment base to support social services like health care, but we see the impacts of that on the housing market. So governments are stuck between a rock and a hard place. The only sustainable way the health care system is going to get better is to leverage technology to improve the efficiency of diagnosis and care. In comes Sparta with its autonomous medicine platform called Doc-in-a-Box, sort of like the next generation of WebMD. The goal of this platform is to enable medical professionals to diagnose illnesses faster and more accurately, particularly in isolated communities where health care services may be lacking. It's in the early stages and there are likely other companies out there trying similar ideas, but I like what Sparta is trying to do and believe it's an all-hands-on-deck effort across Canada to improve the health care system. Not only are we suffering from a lack of doctors across the country, doctors are susceptible to their own biases. For instance, I have heard stories from women saying that they aren't always taken seriously when they report symptoms to their doctor. We need doctors to be making diagnoses, not sticking their own worthless opinions or biases into the mix. An ageless, genderless and raceless AI that can work 24/7 and doesn't get tired or distracted with too many patients is more likely to make accurate diagnoses.

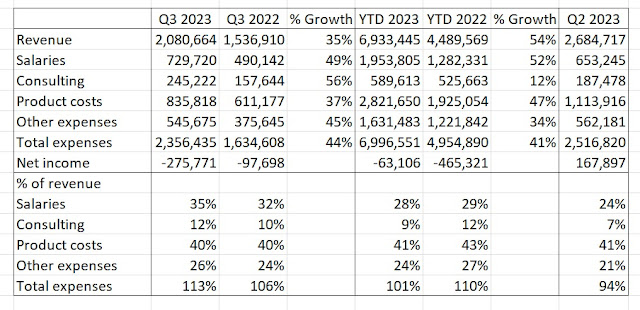

In addition to Sparta being an innovative green energy and health tech company with multiple irons on the fire, its financials are in pretty decent shape. It lost money in its Q3 (ended in June as it has a September year-end) which results in a nine-month year-to-date net loss of $63,000 on just under $7 million in revenue. Prior to that point, it had generated a positive net income for the first six months of its fiscal year. As in other words, this company is essentially breakeven and with revenue growth being 54% for the first nine months of the year, is on pace to be consistently profitable in the next several quarters. So Sparta isn't a big-talking and big money-losing operation one would expect from an environmental technology company valued at less than $10 million.

When we break down the numbers, it shows something else that I find important about the company:

Sparta lost $276,000 on over $2 million in revenue in Q3. Salaries and benefits expense took up 35% of the revenues, leading to the net loss. This company lost money in the quarter because of its recent hiring. And a company only aggressively hires staff when it expects to continue growing. Had Sparta's salaries and benefits been $200,000 lower - flat to 2022 Q3 - it would have pulled in a loss of less than $100,000 and retained profitability on the year. Sparta losing money because of hiring is not a bad thing. Especially while doing so it can prove itself to be a good corporate citizen.

That scumbag Trudeau is finally paying for it at the polls with the fallout from his scheme of bringing in high numbers of immigrants and temporary foreign workers in an illusion to appear "progressive" and pro-diversity when reality it's so his LPC corporate donors can keep wages low and rents high. Sparta can't do anything about the rents, but it is doing something about the wages.

To my knowledge, Sparta doesn't spend a penny in recruitment costs. Sparta's workforce is comprised mainly of non-white and immigrant communities of Scarborough. Instead of people earning minimum wage to clean toilets at Walmart and Tim Hortons, they are being paid decent wages to handle electronic waste at ERS. It's not demeaning or disgusting work and appears to be quite interesting and fulfilling. That's why when Sparta is looking to hire, it just has to tell some of its employees to go ask around in their communities for anyone who is interested. So instead of a corporation that abuses their immigrant employees, here is one that treats them well, and showed a net loss in Q3 partly because of that.

Bay Street doesn't care about this kind of stuff. But other investors might. I ask people do you want to invest in a company that might make decent money now but does so as a multi-national corporation that squeezes the middle class and immigrant communities of Canada for those profits? Or do you want to invest in a company with roots in East Toronto that has a reasonable chance at attaining consistent profits while also doing good work in saving the environment and health care system while paying its workers in the community a decent wage? I sleep well at night having invested in the latter. Sparta only has a few dozen employees so it's only making a miniscule dent into the problem. But by supporting and investing in this company, one can help to make it grow. We need thousands of companies with the attitude, environmental focus and corporate culture like Sparta. For now, at least I can start with this one.

Disclosure: I am long SAY.V